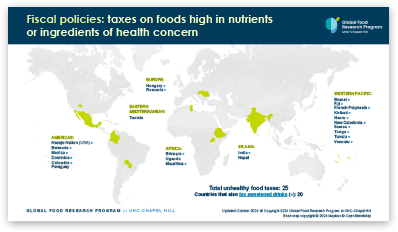

Global maps showing countries and smaller jurisdictions with taxes on sugary or sweetened beverages and/or foods high in nutrients or ingredients of health concern. The taxes included here aim to curb intake of sugar, salt, saturated or trans fat, or excessive calories to”’ improving public health; to encourage industry to shift their products and portfolios towards healthier products; and to raise revenue. Included are brief descriptions of each tax design and dates of implementation and updates.

January 2026 update: Updated beverage tax rates for Mexico, Latvia, France, United Arab Emirates, and Thailand; added new Mexico tax on beverages containing non-nutritive sweeteners and new Slovenia tax; updated Italy’s implementation date (delayed from January 2026 to January 2027).

Note: Additional taxes that apply to sweetened and other beverages can be found in the World Bank’s SSB Tax database and the World Health Organization’s GIFNA database. Not all taxes from those database are included here due to our specific scope of health-focused taxes targeting sweetened beverages and ultra-processed and/or high-in saturated fat, salt, sugar, or calorie foods. (e.g., Countries that tax plain packaged waters at a similar rate to sweetened beverages are excluded.)

Learn more about fiscal policies in our partner countries and the evidence for taxing sugary drinks as a fiscal policy to improve public health.

Maps are for illustrative purposes only and do not imply an expression of opinion on the legal status of any country or territory.