To date, over 50 countries and smaller jurisdictions around the world have enacted taxes on sugary drinks to improve population health. These taxes aim to reduce consumers’ sugary drink intake and encourage companies to offer healthier product options. They can also raise revenue to support other health promotion efforts. This policy approach has gained much momentum over the past decade, with 36 taxes implemented in just the last 5 years. The body of research evaluating sugary drink taxes has also grown.

In an article published this month in BMC Public Health, Shu Wen Ng and coauthors Arantxa Colchero and Martin White review tax evaluations conducted to date and outline lessons learned to inform future work in this area. They describe key evaluation steps and considerations, including:

- Understanding the tax policy and its context;

- Determining the feasibility of a policy evaluation (including whether different stakeholders can find consensus on research priorities and questions);

- Choosing the optimal study design and methods; and

- Identifying the appropriate outcome measures, data sources, and evaluation timing.

The authors also highlight and offer suggestions for many practical challenges that evaluators will likely face, such as:

- Data availability;

- Time constraints;

- Resource needs and costs;

- Political acceptability;

- Media attacks from parties with vested interests (e.g., political think-tanks or beverage industry foundations);

- Making sense of the findings; and

- Communication of evaluation findings beyond academia.

“We hope this paper can serve as a resource for policymakers, funders, and researchers as they commission and conduct rigorous evaluations of policies like sweetened beverage taxes that are gaining traction, globally.” — Shu Wen Ng, PhD

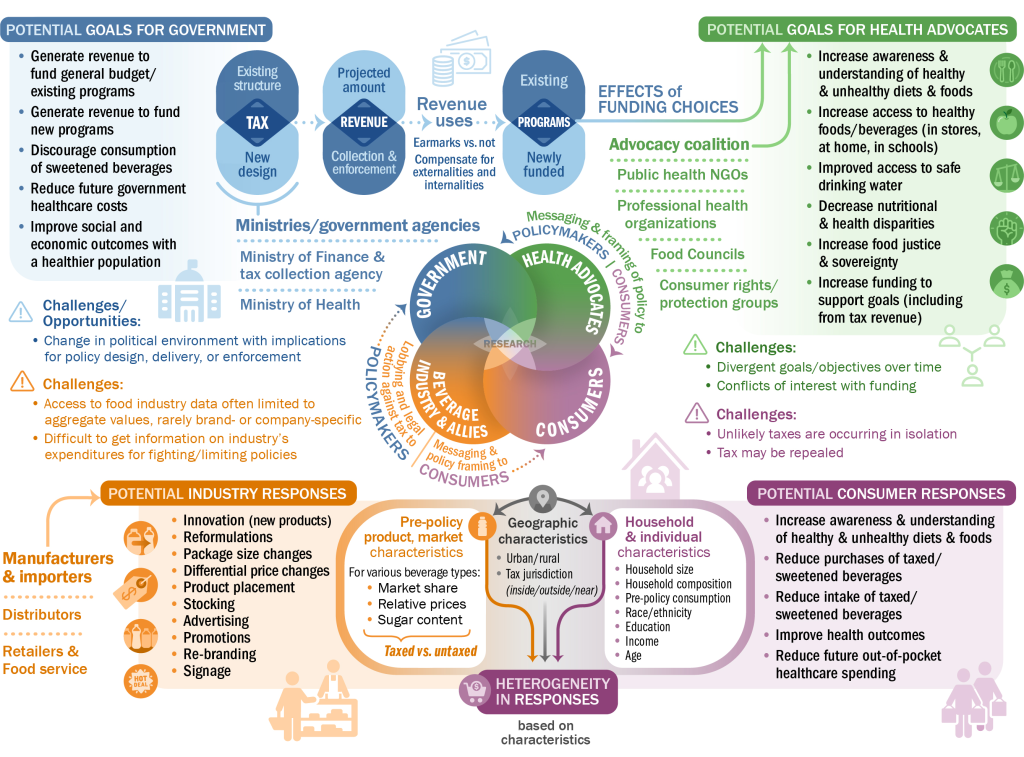

The article includes a diagram (below) depicting different stakeholders (government, health advocates, consumers, and industry) and their goals for and potential responses to a sweetened beverage tax. The authors stress the importance and value of engaging these stakeholders in all aspects of a study’s planning, design, execution, and dissemination.

(Download PDF version.)

Read the full article in BMC Public Health.

GFRP AUTHOR:

COAUTHORS

RESOURCES:

Why tax sugary drinks?

Learn more in our sugary drink tax fact sheet.

View the 50+ sweetened beverage taxes around the world in our sugary drink tax policy maps.